As a homeschooling parent, you have a unique opportunity to shape your child’s education and prepare them for a successful future. And while many homeschool curricula focus on traditional subjects like math, science, and language arts, there’s one crucial area that often gets overlooked: financial literacy.

As a homeschooling parent, you have a unique opportunity to shape your child’s education and prepare them for a successful future. And while many homeschool curricula focus on traditional subjects like math, science, and language arts, there’s one crucial area that often gets overlooked: financial literacy.

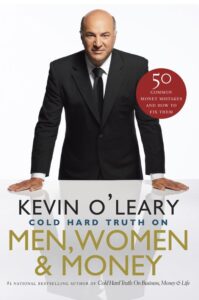

Enter Kevin O’Leary, the renowned entrepreneur, investor, and author of “The Cold Hard Truth on Men, Women, and Money,” who offers valuable insights and advice on how to foster financial responsibility and savvy from a young age.

In his book, O’Leary emphasizes the importance of developing a healthy relationship with money and understanding one’s financial situation. He advocates for saving, investing wisely, and managing expenses throughout life – habits that are best cultivated early on. As a homeschooling parent, you have the power to integrate these principles into your child’s education, setting them on a path towards long-term financial security and success.

One of the key concepts O’Leary introduces is the “90-Day Number” – a simple yet effective tool for gaining a clear picture of your finances. By tracking all income and expenses for three months, you can identify spending patterns, areas for improvement, and opportunities for saving. This exercise is not only valuable for adults but also for children, who can learn the importance of budgeting, record-keeping, and financial discipline from a young age.

To incorporate this concept into your homeschool curriculum, consider having your child track their own income (whether from allowance, gifts, or small jobs) and expenses for a 90-day period. Encourage them to categorize their spending, distinguish between needs and wants, and set savings goals. By making this a regular practice, you’ll help your child develop a keen awareness of their financial habits and empower them to make informed decisions about their money.

Another crucial lesson from O’Leary’s book is the importance of viewing education as an investment. He suggests aligning education choices with career goals to ensure a return on investment, considering factors like scholarships and potential earning capacity. As a homeschooling parent, you have the flexibility to tailor your child’s education to their unique interests and aspirations. Encourage them to explore potential career paths, research the skills and qualifications required, and make informed decisions about their educational pursuits.

O’Leary also stresses the value of financial literacy from a young age, advocating for parents to teach their children about money management early on. One practical way to do this is through the “Secret 10” concept – encouraging your child to save 10% of their income consistently. Help them set up a savings account, explain the power of compound interest, and demonstrate how small, regular contributions can add up to significant savings over time.

In addition to saving, it’s crucial to teach your child about responsible spending. O’Leary warns against common financial pitfalls, such as accumulating credit card debt, overspending on depreciating assets, and making unwise investments. Engage your child in discussions about the difference between needs and wants, the importance of living within one’s means, and the potential consequences of poor financial decisions. By fostering open, honest conversations about money, you’ll help your child develop a healthy, proactive approach to their finances.

Finally, consider incorporating practical financial skills into your homeschool curriculum. Teach your child how to create a budget, balance a checkbook, read a credit report, and file taxes. Encourage them to seek out resources and advice from qualified professionals, such as financial advisors or accountants. By equipping your child with these essential skills and knowledge, you’ll empower them to navigate the complex world of personal finance with confidence and competence.

At QMAK, we believe that financial literacy is a vital component of a well-rounded, holistic education. By incorporating the lessons and insights from Kevin O’Leary’s “The Cold Hard Truth” into your homeschool curriculum, you’ll be giving your child a priceless gift: the tools and mindset they need to achieve long-term financial security and success. So start the conversation today, and watch as your child develops a healthy, proactive relationship with money that will serve them well throughout their life.

Remember, as a homeschooling parent, you have the power to shape your child’s financial future. By making financial literacy a priority in your curriculum, you’ll be setting them up for a lifetime of informed decision-making, responsible money management, and, ultimately, the freedom and peace of mind that come with financial stability. And that, in the words of Kevin O’Leary, is the cold, hard truth.